Trusted by 500+ businesses

Contractor Compliance Made Simple

Automate W-9 collection, insurance tracking, and document management. Stay audit-ready with real-time compliance monitoring for all your contractors.

-

Reduce audit risk

-

Automate W-9 collection

-

Track compliance in real-time

Businesses Trust Us

Contractors Managed

Employees are managed at here

Support Available

Product Demo

See Easy W9 in Action

Watch how Easy W9 simplifies contractor compliance management from onboarding to audit-ready reporting.

This 2-minute walkthrough covers contractor onboarding, document collection, compliance tracking, and reporting features.

Quick Setup

Get started in under 5 minutes with our guided onboarding

Self-Service Portal

Contractors upload their own documents directly

Real-Time Tracking

Monitor compliance status across all contractors

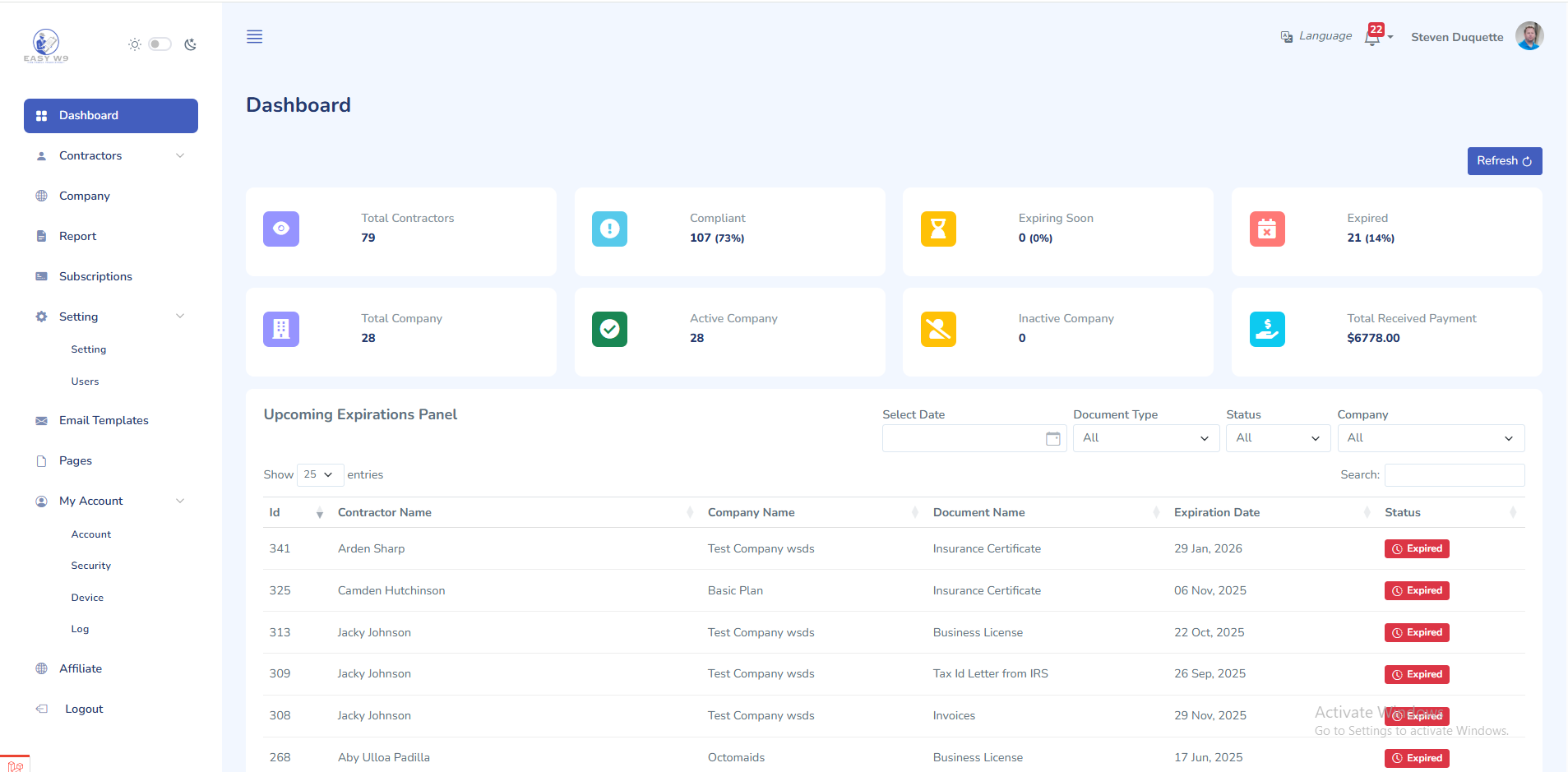

Platform Features

Everything You Need for Contractor Compliance

Easy W9 provides a complete suite of tools to manage your contractors, collect required documents, and maintain compliance effortlessly.

Contractor Management

Add, edit, and manage all your contractors in one place with detailed profiles, business information, and real-time status tracking.

Compliance Tracking

Real-time dashboard showing compliance percentages, expiring documents, and action items at a glance. Never miss a deadline.

Reporting & Export

Generate detailed compliance reports and export data in CSV or PDF format for audits, tax season, and record-keeping.

Document Collection

Collect W-9s, insurance certificates, business licenses, and more through automated requests and contractor self-service uploads.

Automated Notifications

Get instant alerts when contractors upload documents, when documents expire, or when immediate action is needed.

Vendor W-9 Requests

Send W-9 requests to vendors with a single click and track responses with a complete audit trail.

Simple Process

How Easy W9 Works

Get started in minutes. Our streamlined process makes contractor compliance management effortless.

Add Your Contractors

1

Enter contractor details manually or invite them to self-register through a simple onboarding link. Contractors can create their own profiles and upload documents directly.

Collect Documents

2

2

Contractors upload their W-9, insurance certificates, business licenses, and other required documents directly to the platform. Automated reminders ensure timely submissions.

Track Compliance

3

Monitor document status in real-time, receive expiration alerts, and generate reports to stay audit-ready. Your compliance dashboard shows everything at a glance.

Document Types

Collect All Required Documents in One Place

Easy W9 supports all the document types you need to maintain contractor compliance. Set requirements per contractor and track expiration dates automatically.

W-9 Form

IRS tax identification form required for all contractors

Business License

State and local business registration documents

Tax ID Letter

Official IRS documentation and EIN verification

Bank Account Info

Payment details for direct deposit setup

Insurance Certificate

Proof of liability coverage and workers’ compensation

MSA Agreement

Master Service Agreements and contracts

Invoices

Contractor billing records and payment documentation

Misc Documents

Additional supporting files and certifications

Compare Your Options

Why Easy W9

See how Easy W9 stacks up against manual processes and spreadsheet-based tracking. The choice is clear.

|

Feature

|

Easy W9

|

Manual

|

Spreadsheets

|

|---|---|---|---|

|

Automated W-9 Collection

|

|

|

|

|

Real-Time Compliance Tracking

|

|

|

|

|

Automatic Expiration Alerts

|

|

|

|

|

Contractor Self-Service Portal

|

|

|

|

|

AI-Powered Data Extraction

|

|

|

|

|

Audit-Ready Reports

|

|

|

|

|

Document Version History

|

|

|

|

|

Multi-Document Support (8+ types)

|

|

|

|

|

Secure Cloud Storage

|

|

|

|

|

Secure Cloud Storage

|

|

|

|

- Full Support

- Partial / Manual Effort

- Not Available

Ready to upgrade from manual processes?

Built for Businesses Like Yours

Industries We Serve

Easy W9 helps businesses across industries manage contractor compliance efficiently, from small teams to enterprise operations.

Cleaning Services

Manage cleaning crews and subcontractors across multiple locations. Track insurance and background checks for all team members.

Construction

Track subcontractor compliance for job sites. Ensure all workers have proper insurance, licenses, and certifications.

Staffing Agencies

Onboard temporary workers efficiently with automated document collection. Scale your compliance process as you grow.

Property Management

Manage maintenance contractors, landscapers, and service providers. Keep all vendor documentation organized and current.

Consulting Firms

Handle freelancer and consultant documentation seamlessly. Maintain compliance for your extended workforce.

Healthcare

Track credentialing for medical contractors and locum tenens. Ensure compliance with healthcare regulations.

Security & Trust

Your Data is Safe with Us

We take security seriously. Easy W9 is built with enterprise-grade security features to protect your sensitive contractor information.

Two-Factor Authentication

Protect your account with 2FA for an extra layer of security on every login.

Data Encryption

All data is encrypted in transit and at rest using industry-standard protocols.

Secure Document Storage

Documents are stored securely in the cloud with redundant backups.

Complete Audit Trail

Every action is logged with timestamps. Know who did what and when.

Role-Based Access

Control who can view and manage contractor information with granular permissions.

Regular Backups

Automatic daily backups ensure your data is never lost.

Frequently Asked Questions

Everything you need to know about Easy W9, W-9 compliance, and contractor management.

A W-9 form (Request for Taxpayer Identification Number and Certification) is an IRS form used to collect the taxpayer identification number (TIN) of contractors you pay. You need W-9s to properly report payments to the IRS via 1099 forms. Failing to collect W-9s can result in backup withholding requirements of 24% and potential IRS penalties of up to $280 per missing form

You must file a 1099-NEC form for any contractor you paid $600 or more during the tax year. Forms must be sent to contractors by January 31st and filed with the IRS by the same date. Easy W9 helps ensure you have all the W-9 information needed to file accurate 1099s on time.

Backup withholding requires you to withhold 24% of payments to contractors who haven’t provided a valid TIN. This creates additional administrative burden and cash flow issues. By collecting W-9s upfront with Easy W9, you avoid backup withholding requirements entirely.

The IRS recommends keeping W-9 forms for at least 4 years after the last tax return that references the contractor. Easy W9 stores all documents securely in the cloud with unlimited retention, so you never have to worry about losing important records.

Easy W9 automatically tracks expiration dates for all documents including insurance certificates and business licenses. You’ll receive email notifications 30, 14, and 7 days before documents expire, giving you time to request updated versions. The dashboard shows expiring and expired documents at a glance so nothing falls through the cracks.

Generally, you don’t need to file 1099s for payments to C-corporations or S-corporations (with some exceptions like legal fees). However, collecting W-9s from all contractors helps you verify their business structure and ensures you have documentation if the IRS ever questions your filing decisions.

Our AI uses advanced OCR (Optical Character Recognition) and machine learning to automatically extract key information from uploaded documents. When a contractor uploads a W-9, insurance certificate, or other document, the AI identifies and extracts fields like business name, TIN, address, and expiration dates with 99% accuracy. This eliminates manual data entry and reduces errors.

Yes! Contractors can self-register through a simple onboarding link you share with them. They create their own profile and upload documents directly to the platform. This self-service approach saves you time, ensures contractors take ownership of their documentation, and provides a better experience for everyone.

Easy W9 supports eight document types: W-9 Forms, Insurance Certificates (COIs), Business Licenses, MSA Agreements, Tax ID Letters from the IRS, Invoices, Bank Account Information for payments, and Miscellaneous Documents. You can customize which documents are required for each contractor based on your business needs.

Yes, Easy W9 supports multi-company management. You can create separate workspaces for different companies, locations, or departments while maintaining a single login. Each workspace has its own contractors, documents, and settings, making it easy to manage compliance across your entire organization.

Easy W9 is fully responsive and works great on mobile devices through your web browser. Contractors can easily upload documents from their phones by taking photos. We’re also developing native iOS and Android apps for an even better mobile experience—stay tuned for updates!

We take security seriously. All data is encrypted in transit using TLS 1.3 and at rest using AES-256 encryption. We offer two-factor authentication (2FA), role-based access controls, IP allowlisting, and maintain complete audit trails. Our infrastructure is hosted on SOC 2 compliant data centers with 99.9% uptime.

Only authorized users in your organization can access contractor documents. You control access through role-based permissions—admins can manage all contractors, while standard users may have view-only access or access to specific contractor groups. Every access is logged in the audit trail.

Still have questions? We're here to help.

Our Pricing

At Outgrid, we offer flexible pricing options to match your content needs.

Basic

$

99

/mo

-

Access up to 20 contractors

-

Email support included

-

$15 additional cost per contractor

-

Only the company can upload documents

-

Only the company can add contractor information

Most Popular

Pro

$

159

/mo

-

Access up to 5 contractors

-

Email and contact support included

-

$15 additional cost per contractor

-

Both company and contractors can upload documents

-

Company can add contractor information, and contractors can also register under a company

Premium

$

199

/mo

-

Access up to 10 contractors

-

Email and contact support included

-

$15 additional cost per contractor

-

Both company and contractors can upload documents

-

Company can add contractor information, and contractors can also register under a company

Built for Businesses Like Yours

Industries We Serve

Easy W9 helps businesses across industries manage contractor compliance efficiently, from small teams to enterprise operations.

Cleaning Services

Manage cleaning crews and subcontractors across multiple locations. Track insurance and background checks for all team members.

Construction

Track subcontractor compliance for job sites. Ensure all workers have proper insurance, licenses, and certifications.

Staffing Agencies

Onboard temporary workers efficiently with automated document collection. Scale your compliance process as you grow.

Property Management

Manage maintenance contractors, landscapers, and service providers. Keep all vendor documentation organized and current.

Consulting Firms

Handle freelancer and consultant documentation seamlessly. Maintain compliance for your extended workforce.

Healthcare

Track credentialing for medical contractors and locum tenens. Ensure compliance with healthcare regulations.